The ask

Create a six month financial plan with total season sales, monthly sales, stock to sale ratios, markdowns, purchases, turnover, and gross margin, as well as including justifications based on research.

the process

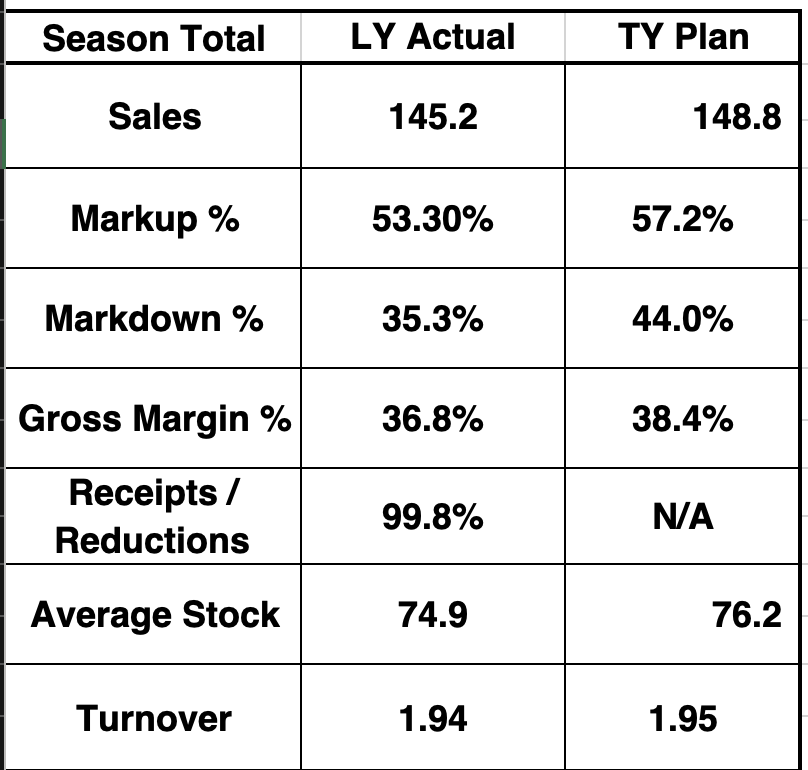

Through market research, my partner and I began justifying the allocation of planned sales each month based on both external factors and internal factors. For example, we predicted November to see the largest increase at 1.2 million due to the fact that there is an extra week after Thanksgiving to generate sales. With the goal of a 2.5% increase in season total sales, based on researching consumer purchasing habits, we were able to allocate and plan sales per month to attain such increase.

Additional factors, such as the stock/sales ratio, were obtained by conducting research on Nordstrom's present performance and its anticipated revenue for the upcoming year. BOM stock was computed by taking the beginning and end of each month's stock levels and comparing them to the previous months' data. We formulated our markdown strategies by figuring out how to set the plan apart from the previous year's while retaining revenue. Finally, our retail purchases were determined by taking into account every other aspect of the six-month strategy.